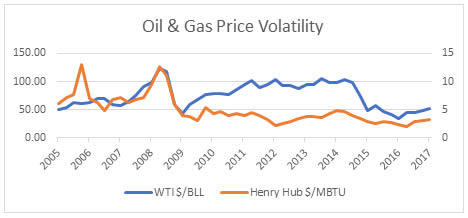

The oil and gas industry has seen a decade of extreme price volatility, disruptive technological innovations, and shifting geopolitical landscapes. Technologies such as horizontal drilling, hydraulic fracturing, and ultra-deep-water exploration have revolutionized the industry. These advancements have opened new markets and significantly impacted prices. Conversely, price fluctuations have created environments where new technologies can thrive. To fully comprehend these developments, one must consider the intricate interplay with the geopolitical landscape.

The Need for Advanced Planning Tools

Forward planning in oil and gas requires a deep understanding of all factors and players in the system. Traditional investment analysis tools like extrapolation and discounted cash flow methods are insufficient for navigating this complex, volatile, and uncertain industry. Instead, scenario planning and real options theory have become the go-to strategies for successful future navigation.

Evolution of Scenario Planning in Oil and Gas

Scenario planning has been a staple in the oil and gas industry for almost 50 years. It has enabled many companies and governments to plan long-term while managing uncertainty. Investors and banks are now incorporating scenario-based financial analyses into their methodologies. Industry frontrunners are enhancing their toolkits with real option valuation, big data analysis, and artificial intelligence technologies.

Top Picks:

- Data Science & Big Data Analytics Training Course

- Scenario Planning in the Oil and Gas Industry Training Course

- Strategic Planning, Development & Implementation Training Course

- Risk Assessment & Risk Management for Oil & Gas Projects Training Course

Integrating Scenarios with Strategic Planning

Scenarios are most beneficial for oil and gas companies when integrated into the strategic planning process. Linking scenarios to activities like road mapping and business intelligence is crucial for receiving early warning signals. This integration minimizes risks and maximizes opportunities that scenarios help prepare for.

What You Will Learn in Our Course

In our course, “Scenario Planning in the Oil and Gas Industry,” you will explore the latest theories and practices in this field. You will not only hone your professional skills with these tools but also learn about recent scenario studies and their implications. By the end of the course, you will be equipped with new analytical and planning tools and up-to-date foresight, enabling your organization to better handle complexity, volatility, and uncertainty.

Build Career In:

Why Scenario Planning is Essential

- Adapt to Market Volatility: Understand and leverage market fluctuations to stay ahead.

- Incorporate Technological Innovations: Learn how new technologies can be integrated into your strategic plans.

- Navigate Geopolitical Changes: Gain insights into how geopolitical shifts impact the oil and gas sector.

- Maximize Investment Returns: Use scenario planning and real options theory to make informed investment decisions.

- Early Warning Signals: Implement business intelligence to anticipate and mitigate risks.

Get Started Today

Join our course to gain a comprehensive understanding of scenario planning in the oil and gas industry. Equip yourself with the knowledge and tools to lead your organization through uncertain times successfully.

Enroll Now

By refreshing and updating your knowledge, you’ll be better prepared to tackle the challenges and seize the opportunities that the future holds. Sign up for our course today and take the first step towards mastering the complexities of the oil and gas industry.