What Is Brent Crude? Brent Crude Oil Price Chart

Brent Crude is one of the world’s most important benchmarks for crude oil pricing, widely used to determine the value of oil traded across global markets. When energy analysts, traders, and governments refer to international oil prices, they are often referencing Brent Crude, making it a central indicator in the global energy economy. Its price influences contracts, shipping decisions, investment strategies, and long-term energy planning across continents.

As a benchmark, Brent plays a key role in shaping the global oil price index, guiding how crude is bought, sold, and traded in international markets. The Brent Crude oil price chart is frequently monitored by investors, refiners, policy makers, and financial institutions because it reflects supply-demand dynamics, geopolitical movements, production levels, and global economic outlooks. From futures markets to physical oil trade contracts, Brent Crude provides a transparent and trusted reference point that drives pricing worldwide.

Understanding what is Brent Crude is essential for anyone involved in energy, finance, shipping, or commodity trading. Its characteristics, origin, and market behaviour distinguish it from other oil grades—especially West Texas Intermediate (WTI)—and make Brent the preferred pricing benchmark for Europe, Africa, the Middle East, and a large portion of Asia.

➡️Explore Oil & Gas Training Courses

What Is Brent Crude?

Brent Crude is a high-quality, light, sweet crude oil blend that serves as one of the world’s most widely used pricing benchmarks for global oil markets. When people refer to international oil prices, they are often referencing Brent Crude oil, making it essential for traders, refiners, and governments across multiple continents.

Definition and Classification

Brent Crude is classified as:

- Light crude oil – because it has a relatively low density

- Sweet crude oil – due to its low sulfur content, typically around 0.37%

These properties make Brent easier and cheaper to refine into petroleum products such as gasoline, diesel, and jet fuel. Its favourable refining characteristics are one reason it has become a dominant benchmark in global markets.

Key Characteristics of Brent Crude

- Low sulfur content (sweet), which reduces the need for costly desulfurization

- Higher yield of premium fuels during the refining process

- Consistent quality due to blending across several North Sea fields

- Global benchmark status used in international oil price contracts

Role as a Global Benchmark

The Brent crude meaning extends beyond its physical qualities—it represents a pricing standard that influences millions of barrels of oil traded daily. Brent is the primary benchmark for crude oil pricing across Europe, Africa, the Middle East, and parts of Asia, making it central to global energy markets.

Its widespread use reflects confidence in its stability, transparency, and relevance to international crude supply patterns. For this reason, Brent remains one of the most closely monitored and widely referenced commodities in global finance and energy economics. ➡️A – Z of the Petroleum Industry Training Course

Where Is Brent Crude From? (North Sea Origin Explained)

Brent Crude originates from the North Sea, a region known for producing some of the highest-quality crude oils in the world. The benchmark is not tied to a single oilfield but is instead derived from a blend of several major North Sea production streams. This blend ensures consistent quality, stable supply, and reliability for global pricing.

The Original Brent Field

The name “Brent” comes from the Brent oilfield, discovered and operated by Shell in the 1970s. Located northeast of Scotland, the Brent field quickly became one of the most productive in the region and played a major role in establishing the U.K. as a key oil producer. As North Sea facilities expanded, Brent became the reference point for physical crude pricing in Europe and far beyond.

The Modern Brent Benchmark (BFOET System)

As output from the original Brent field declined, the benchmark evolved into a broader blend of crude oils known as the BFOET system, which includes:

- Brent

- Forties

- Oseberg

- Ekofisk

- Troll

This expanded grouping reflects the modern reality of North Sea oil production, ensuring that Brent remains liquid, reliable, and representative of regional crude quality. The BFOET blend is regularly updated to maintain its accuracy as production levels change.

Why the North Sea Matters

The North Sea is a politically stable, highly regulated region with transparent production data—key reasons why Brent became a trusted global benchmark. Its high-quality crude, combined with reliable supply infrastructure, makes Brent a preferred reference price for international oil trades across Europe, Africa, and the Middle East.

Brent Crude Origin at a Glance

- Origin: North Sea oilfields

- Benchmark system: BFOET

- Operator history: Initially based on Shell’s Brent field

- Role: Foundation of one of the world’s most important oil price indicators

This unique origin story is a major part of what gives Brent its credibility, consistency, and global relevance in energy markets.

What Is Brent Crude Oil Used For?

Brent Crude is one of the most versatile and economically valuable crude oil grades in the global energy market. Its light and sweet characteristics—meaning low density and low sulfur content—make it easier and more cost-effective to refine into high-demand petroleum products. Beyond its physical uses, Brent also plays a crucial financial role as a global pricing benchmark for crude oil trading.

-

Refining Into Gasoline (Petrol)

Because Brent is a light crude, it produces a high yield of gasoline during the refining process. This makes it especially valuable for regions with high transportation fuel demand. Refineries prefer light, sweet crude because it requires fewer upgrading processes to produce cleaner, high-quality petrol.

-

Diesel and Jet Fuel Production

Brent also produces strong yields of middle distillates such as diesel, jet fuel, and kerosene. These fuels are essential for commercial aviation, shipping, trucking, and industrial machinery. Low sulfur content helps meet modern environmental regulations with lower refining costs.

-

Petrochemical Feedstock

Brent-derived components are widely used to produce petrochemical feedstocks that form the basis of:

- Plastics

- Synthetic fibers

- Industrial chemicals

- Lubricants

- Fertilizers

This makes Brent a foundational input for global manufacturing and consumer goods industries.

-

Industrial and Heating Fuels

In some markets, Brent Crude is refined into heating oil and industrial fuels used for power generation, commercial boilers, and high-temperature manufacturing processes.

-

Benchmark Pricing for Global Oil Contracts

Beyond its physical use, Brent’s most influential role is as a benchmark price for millions of barrels of crude traded each day. Brent serves as a reference point for crude oil contracts across:

- Europe

- Africa

- The Middle East

- Asia-Pacific

Because Brent Crude oil is widely traded and reflects transparent North Sea production, it is trusted as the basis for global pricing negotiations, futures trading, and long-term supply agreements.

Why Light, Sweet Crude Is Preferred

Brent’s low sulfur content and favourable chemical profile make refining simpler, cheaper, and more efficient. Refineries require fewer energy-intensive processes—like hydrotreating—to meet fuel quality standards. This increases profitability and reduces environmental impact.

In summary, Brent Crude oil is not only a key input for transportation and industrial fuels but also one of the most influential pricing benchmarks in global energy markets.

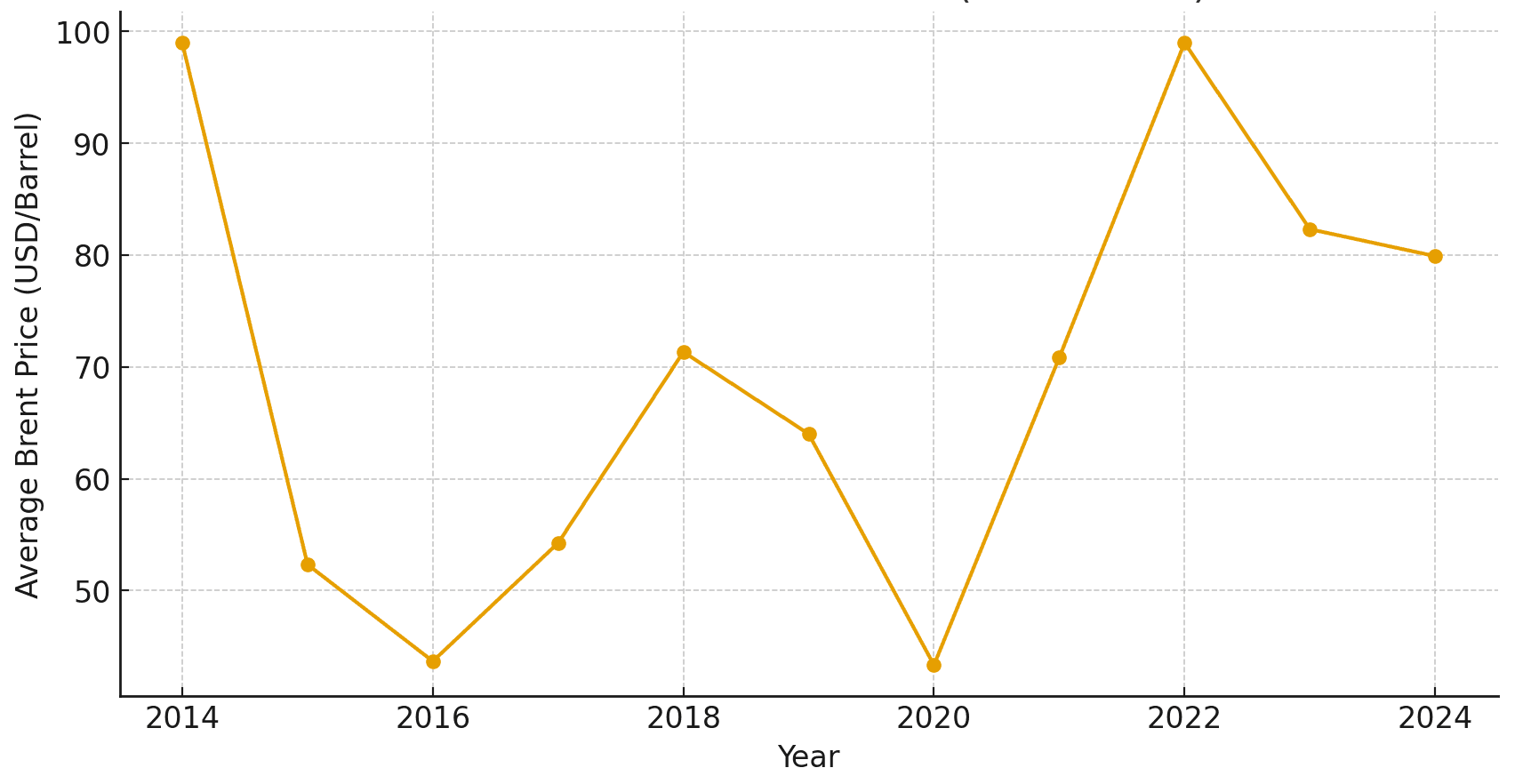

Brent Crude Oil Price Chart (Yearly Comparison)

The Brent Crude oil price chart is one of the most closely monitored indicators in global energy markets. It helps analysts, investors, governments, and refiners understand market volatility, long-term pricing cycles, and the economic or geopolitical forces influencing crude oil pricing. Reviewing year-on-year price trends provides essential insight into how global events—such as supply disruptions, political tensions, pandemics, and OPEC production decisions—shape the movement of Brent oil prices.

Brent prices fluctuate due to several major factors:

- Global supply and demand balance

- OPEC and OPEC+ production agreements

- Geopolitical tensions in the Middle East, Russia, and major producing regions

- Macroeconomic conditions, including inflation, recessions, and currency shifts

- North Sea production trends affecting benchmark supply

- Market sentiment and oil futures trading activity

These influences often create dramatic price swings that become visible through historical charts and data tables.

Yearly Brent Crude Oil Price: 2019–2024

| Year | Average Brent Price (USD/barrel) | Notes / Market Context |

|---|---|---|

| 2019 | 64.00 | Stable pre-pandemic demand, moderate supply levels (Wikipedia) |

| 2020 | 43.33 | Demand collapse due to COVID-19, global lockdowns, oversupply (FRED) |

| 2021 | 70.83 | Demand recovery post-pandemic, production cuts by OPEC+ |

| 2022 | 98.99 | Supply disruptions, geopolitical tensions, tight markets |

| 2023 | 82.32 | Market normalization, slower demand growth |

| 2024 | 79.91 | Relative stability, mild supply-demand balance |

Observations & Key Trends

- The sharp drop from 2019 to 2020 reflects the severe demand shock caused by the COVID-19 pandemic.

- The rebound in 2021 corresponds to global economic recovery and renewed demand for fuel and energy.

- The spike in 2022 underscores how geopolitical events, supply disruptions, and tight global markets influence crude pricing.

- Fluctuations in 2023–2024 show how supply–demand balance, global economic trends, and energy policy shape price stabilization.

Brent Crude Oil Price Chart (2014–2024)

How Brent Crude Became the Global Oil Price Benchmark

Brent Crude did not become the world’s leading oil benchmark by accident—it earned its position through a combination of market transparency, political stability, supply reliability, and high crude quality. Over several decades, these factors transformed Brent into the most trusted reference price in crude oil trading, shaping contracts and investment decisions across Europe, Africa, the Middle East, and Asia.

-

Transparent and Liquid North Sea Market

One of the strongest reasons Brent became dominant is the high level of market transparency in the North Sea.

- Production data is openly reported

- Market participants trust published pricing

- Trading activity is deep and liquid

This openness contrasts with regions where pricing and production numbers are less consistently available, making Brent the preferred benchmark for global buyers and sellers.

-

Political and Regulatory Stability

The North Sea sits between the U.K. and Norway—two of the world’s most politically stable, well-regulated environments.

- No major geopolitical conflicts

- Clear commercial laws

- Predictable regulatory frameworks

This stability ensures Brent pricing isn’t disrupted by political turmoil, a major advantage over other regional benchmarks.

-

Consistent and Reliable Supply

Historically, North Sea oil production provided a steady, dependable supply. Even as individual fields declined, the benchmark adapted by expanding to the BFOET blend (Brent, Forties, Oseberg, Ekofisk, Troll).

- This flexibility helped Brent maintain volume

- Ensured consistent quality

- Sustained its credibility in global markets

Reliable supply is essential in benchmark pricing, giving traders confidence that Brent reflects real, tradable crude.

-

High-Quality Crude Characteristics

Brent is a light, sweet crude oil, meaning:

- Low sulfur content

- High gasoline and diesel yield

- Lower refining costs

Its favourable refining profile makes it a natural fit for global demand patterns, increasing its influence in international pricing.

-

Comparison With Other Major Benchmarks

WTI (West Texas Intermediate)

- Primarily used in North America

- Landlocked infrastructure can create bottlenecks

- More sensitive to U.S. regional logistics

Dubai/Oman Benchmark

- Used for pricing Middle Eastern crude exports

- Heavier and sourer crude profile

- Less transparent due to regional market structure

Compared with these, Brent offers:

- Broader international relevance

- Stronger transparency

- Higher liquidity

- Predictable pricing behaviour

Global Impact Today

Because of these advantages, Brent oil benchmark pricing now influences:

- International shipping contracts

- Futures markets

- Refining margins

- Government budgets

- Energy investment decisions

Its long-standing reputation for reliability ensures Brent remains a cornerstone of global crude oil trading, even as markets evolve and alternative benchmarks emerge.

➡️Oil Production and Processing Facilities Training Course

Factors That Influence Brent Crude Oil Prices

Brent Crude is one of the most closely watched commodities in the world, and its price movements shape global trade, government budgets, energy investments, and transportation costs. Because it serves as a major component of the global oil price index, Brent is influenced by a wide range of economic, political, and structural factors. Understanding these drivers helps analysts and businesses anticipate trends and manage risk more effectively.

Below are the primary crude oil pricing factors that influence Brent in international markets.

-

OPEC+ Production Decisions

The Organization of the Petroleum Exporting Countries (OPEC) and its extended alliance (OPEC+) play a dominant role in global crude supply.

- Production cuts often push Brent prices higher

- Increased output typically drives prices lower

- Coordinated supply adjustments can stabilize volatile markets

Since OPEC+ controls a significant portion of global oil production, its decisions directly impact Brent’s supply-demand balance.

-

Global Economic Cycles

Economic growth fuels energy demand, while slowdowns reduce consumption.

- Strong economic expansion → higher fuel usage → rising Brent prices

- Recessions or downturns → lower demand → falling prices

Events like inflation, interest rate changes, and industrial production shifts create immediate ripple effects across the energy market.

-

Geopolitical Tensions and Conflict

Geopolitical events are one of the biggest drivers of Brent price volatility.

Key regions affecting Brent pricing include:

- Middle East: threats to supply routes (Strait of Hormuz)

- Russia and Eastern Europe: sanctions, conflicts, pipeline disruptions

- Africa: instability in oil-exporting countries such as Libya and Nigeria

Any event that threatens global supply quickly reflects in Brent price movements.

-

Natural Disasters and Supply Disruptions

Storms, hurricanes, or operational failures that affect offshore rigs or shipping channels can cause sudden supply shortages.

Examples include:

- North Sea platform shutdowns

- Extreme weather disrupting transport routes

- Maintenance outages in production hubs

These disruptions create short-term spikes in price due to reduced availability.

-

Currency Fluctuations (Especially USD Movements)

Crude oil is priced globally in U.S. dollars.

- A strong USD generally pushes Brent prices lower (oil becomes more expensive for other currencies)

- A weak USD often increases Brent prices

Currency shifts influence trading behaviour, investment flows, and purchasing power in international markets.

-

Market Speculation and Futures Trading

The oil futures market plays a significant role in Brent price volatility.

- Hedge funds, institutional investors, and traders influence short-term movements

- Buying pressure can push prices higher even without physical shortages

- Negative market sentiment can push prices downward regardless of supply conditions

Speculation is often driven by forecasts, economic data, and geopolitical expectations.

-

Technological and Supply Innovations

Advances in energy technology also influence long-term pricing trends:

- Shale oil production growth in the U.S.

- Improvements in offshore drilling

- Transition to renewable energy

- Efficiency in refining and transport

These trends reshape supply patterns and affect Brent’s global benchmark role.

Brent Crude pricing is ultimately shaped by the interplay of supply forces, demand trends, financial markets, and geopolitical realities. Understanding these factors helps organizations manage risk, forecast budgets, and navigate fluctuations in the global oil price index with greater confidence.

➡️Must Read: What Are the Products of Oil Refining (Fuels, Chemicals, etc.)

Who Owns Brent Crude Oil? Understanding Production & Ownership

One of the biggest misconceptions about Brent Crude is the idea that a single company or country “owns” it. In reality, Brent Crude is not owned by any one entity—it is a global oil benchmark, not a specific oilfield, company, or government asset. Instead, Brent represents a pricing standard used worldwide to value crude oil contracts, futures, and physical shipments.

-

Brent Crude as a Benchmark—Not a Single Asset

Brent is best understood as a market benchmark, similar to how stock indexes like the S&P 500 operate.

- No single company owns Brent

- No government controls it directly

- It is a blend of crude from multiple North Sea fields

- It acts as a transparent reference price for global crude oil trading

This benchmark system helps ensure fairness and consistency in international energy markets.

-

Who Produces Brent Crude? (North Sea Operators)

Although the Brent benchmark is not “owned,” it is produced by multiple companies operating oilfields in the North Sea, primarily within U.K. and Norwegian waters.

Major operators contributing to Brent and the broader BFOET blend include:

- Shell – Historically operated the original Brent field

- Equinor (formerly Statoil) – Major producer in Norway

- BP – Key operator in multiple North Sea assets

- TotalEnergies – Contributes to Forties and other fields

- ConocoPhillips – Significant North Sea presence

- Harbour Energy – Operates several U.K. fields

These companies own and operate the physical oilfields but do not own the benchmark itself.

-

Ownership of Oilfields vs. Ownership of the Benchmark

It’s important to distinguish between:

- Ownership of the physical oilfields (held by energy companies through licenses)

- Ownership of Brent as a pricing benchmark (no ownership — it is a market standard)

Oilfield ownership involves:

- Government licensing

- Joint ventures

- Operational rights

- Revenue sharing

But the Brent benchmark is a market reference, not a proprietary product.

-

Who Administers the Brent Benchmark?

While no entity owns Brent, the pricing system is maintained through established price-reporting agencies (PRAs). The most influential is:

- S&P Global Platts (Platts) – Primary administrator of Brent benchmark pricing and assessments

Platts collects market data, assesses cargo trades, and publishes the daily Brent benchmark price. Other organizations such as ICE (Intercontinental Exchange) also play a role through Brent futures trading.

-

Why This Structure Works

The decentralised nature of Brent’s ownership and pricing ensures:

- Transparency

- Fairness

- Global trust

- Efficient crude oil trading

- Reduced political influence

This structure is a major reason Brent is considered the world’s most reliable and widely used oil pricing benchmark.

Must Read: What Is Oil Refining and How Does It Work?

Frequently Asked Questions (FAQs)

What is Brent Crude oil?

Brent Crude is a light, sweet crude oil blend sourced from several North Sea oilfields. It serves as one of the primary global benchmarks for crude oil pricing and is widely used in international energy markets.

Why is it called Brent Crude?

The name comes from the original Brent oilfield, discovered by Shell. Shell named its fields after birds, and “Brent” refers to the Brent goose. Over time, the benchmark retained the name even as it expanded into a broader blend.

Where is Brent Crude from?

Brent Crude originates from the North Sea, specifically from the BFOET fields: Brent, Forties, Oseberg, Ekofisk, and Troll. These fields span U.K. and Norwegian waters.

What is Brent Crude oil used for?

Brent Crude is mainly refined into gasoline, diesel, jet fuel, heating oil, and petrochemical feedstock. Its high quality makes it preferred for producing cleaner, high-value transportation fuels.

How do I invest in Brent Crude?

Investors can gain exposure to Brent Crude through:

- Oil futures contracts (ICE Brent)

- Commodity ETFs and ETNs

- Oil company stocks

- Energy sector mutual funds

- CFD trading (contract for difference)

Direct physical ownership is not common due to storage and logistics challenges.

What is the Brent Crude index?

The Brent Crude index refers to benchmark pricing published by agencies such as S&P Global Platts and used in futures trading on the Intercontinental Exchange (ICE). It represents the global reference price for crude oil.

What affects Brent Crude oil prices?

Major crude oil pricing factors include:

- OPEC+ production decisions

- Global supply and demand

- Geopolitical conflicts

- Economic cycles

- Currency fluctuations (USD)

- Market speculation

- Natural disasters and supply disruptions

These elements contribute to daily volatility in the Brent price.

What is the difference between Brent and WTI?

-

Brent: Light, sweet crude sourced from the North Sea; used as a global benchmark.

-

WTI (West Texas Intermediate): Light, sweet U.S. crude sourced from Texas; benchmark mainly for North America.

WTI is typically slightly lighter and sweeter, while Brent represents a broader international market.

Who owns Brent Crude oil?

No single entity owns Brent Crude. It is a benchmark, not a field. Various companies—including Shell, Equinor, BP, TotalEnergies, and others—produce the crude that forms the Brent blend. Pricing is administered by agencies like Platts.

Is Brent Crude better than WTI?

Both are high-quality crude oils.

-

WTI is slightly lighter and sweeter, making it ideal for gasoline production.

-

Brent is more widely used globally due to its benchmark role and geographic accessibility.

The “better” grade depends on refinery configuration and market needs.

Why is Brent Crude used as a global benchmark?

Brent became the global benchmark because of:

- Transparent North Sea production

- Political stability in the region

- Consistent high-quality crude

- Strong trading liquidity

- Broad international relevance

These factors make Brent the preferred pricing reference for more than two-thirds of internationally traded crude.

How often do Brent Crude prices change?

Brent prices update continuously during global trading hours. Futures markets, news events, and trading activity cause real-time fluctuations.

What industries rely on Brent Crude pricing?

Industries influenced by Brent pricing include:

- Oil and gas

- Petrochemicals

- Shipping and logistics

- Aviation

- Manufacturing

- Utilities and power generation

- Financial trading and commodities markets

These sectors use Brent pricing for budgeting, procurement, hedging, and investment decisions.